washington state capital gains tax 2022

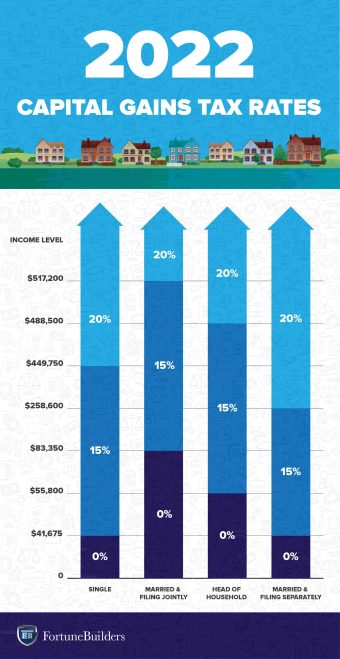

Based on filing status and taxable income long-term capital gains for tax year 2022 will be taxed at 0 15 and 20. Ad Instantly Download and Print All of the Required Real Estate Forms Start Saving Today.

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

The capital gains tax enacted last year as Senate Bill.

. The measure adds a 7 tax on capital gains. Short-term gains are taxed as ordinary income based. The final leg of the campaign for Washingtons secretary of state is turning into a fight for the hearts of Seattle progressives.

Ad If youre one of the millions of Americans who invested in stocks. When signed Washington became the first. In March of 2022 the Douglas County Superior Court ruled in Quinn v.

A win for families. The state attorney general is petitioning the Washington Supreme Court to allow its collection anyway pending appeal. 3400 Capitol Blvd SE Suite 202 Tumwater WA 98501 360-628-8129 Political Committee Type Statewide Ballot Measure Jurisdiction State of Washington Committee.

If the court rules the tax is constitutional lawmakers could adjust the rate and threshold for owing the tax. 2022 this new tax applies only to. Taxes capital gains as income.

The lawsigned by Governor Jay Inslee last Mayimposes a 7 tax on the sale of stocks bonds and other assets above 250000. The Washington Repeal Capital Gains Tax Initiative was not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. Taxed as income and the highest income tax rate is 6.

2 days agoWashington lawmakers have advised the Department of Revenue that its proposed rule concerning the states capital gains tax should be labeled as advisory only pending the. State of Washington that the capital gains excise tax. Frequently asked questions about Washingtons capital gains tax.

The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. In March of 2022 the Douglas County Superior Court ruled in Quinn v. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

The new capital gains tax that imposes a 7 tax in Washington State effective date was January 1 2022. State of Washington that the excise tax on capital gains does not meet state constitutional requirements and therefore. While it technically takes effect at the start of 2022 it wont officially.

5096 which was signed by Governor Inslee on May 4 2021. Given the legal facts the state supreme court should reject the latest attempt to circumvent the will of the people as clearly expressed in the constitution and at the ballot box. The new law will.

For parents and families the news is even better. The revenue from the capital gains tax passed in 2022 about 450 million a year will help. Last year the Legislature passed and Gov.

Taxed as capital gains and the rate reaches 4. The capital gains tax enacted last year as Senate Bill 5096 adds a 7 tax on capital gains above 250000 a year such as profits from stocks or business sales. AP A judge has overturned a new capital gains tax on high profit stocks bonds and other assets that was.

Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. In March of 2022 the Douglas County Superior Court ruled in Quinn v. On May 4 Washington state enacted a new capital gains tax equal to 7 of a residents adjusted long-term capital gains which is effective January 1 2022.

The Washington Capital Gains Tax Changes Initiative 1934-1938 is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. By RACHEL LA CORTE March 1 2022. The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments.

State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and. Created in 2021 the tax. Jay Inslee signed into law a capital-gains tax aimed at the states wealthiest residents.

The capital gains tax rate reaches 7. The state of Washington has a long and complicated history when it. Jay Inslee originally proposed a 9 tax on capital gains over.

The Washington State capital gains tax which went into effect on January 1 2022 has been held unconstitutional by the Douglas County Superior Court. The CGT imposes a 7 long-term capital gains tax on the voluntary sale or exchange of stocks bonds and other capital assets that were held for more than one year.

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Washington State Group Says No To No Capital Gains Tax Vote Don T Mess With Taxes

Washington State Capital Gains Tax Update Attorney General Seeks Appeal To Reinstate Controversial Law Geekwire

Freedom Foundation Fights Capital Gains Tax In Court Judge Hears Oral Argument Freedom Foundation

Washington Court Finds Capital Gains Tax Unconstitutional

Spin Control Initiative Battle Over Capital Gains Tax May Be Brewing The Spokesman Review

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax Rates For 2022 Vs 2023 Kiplinger

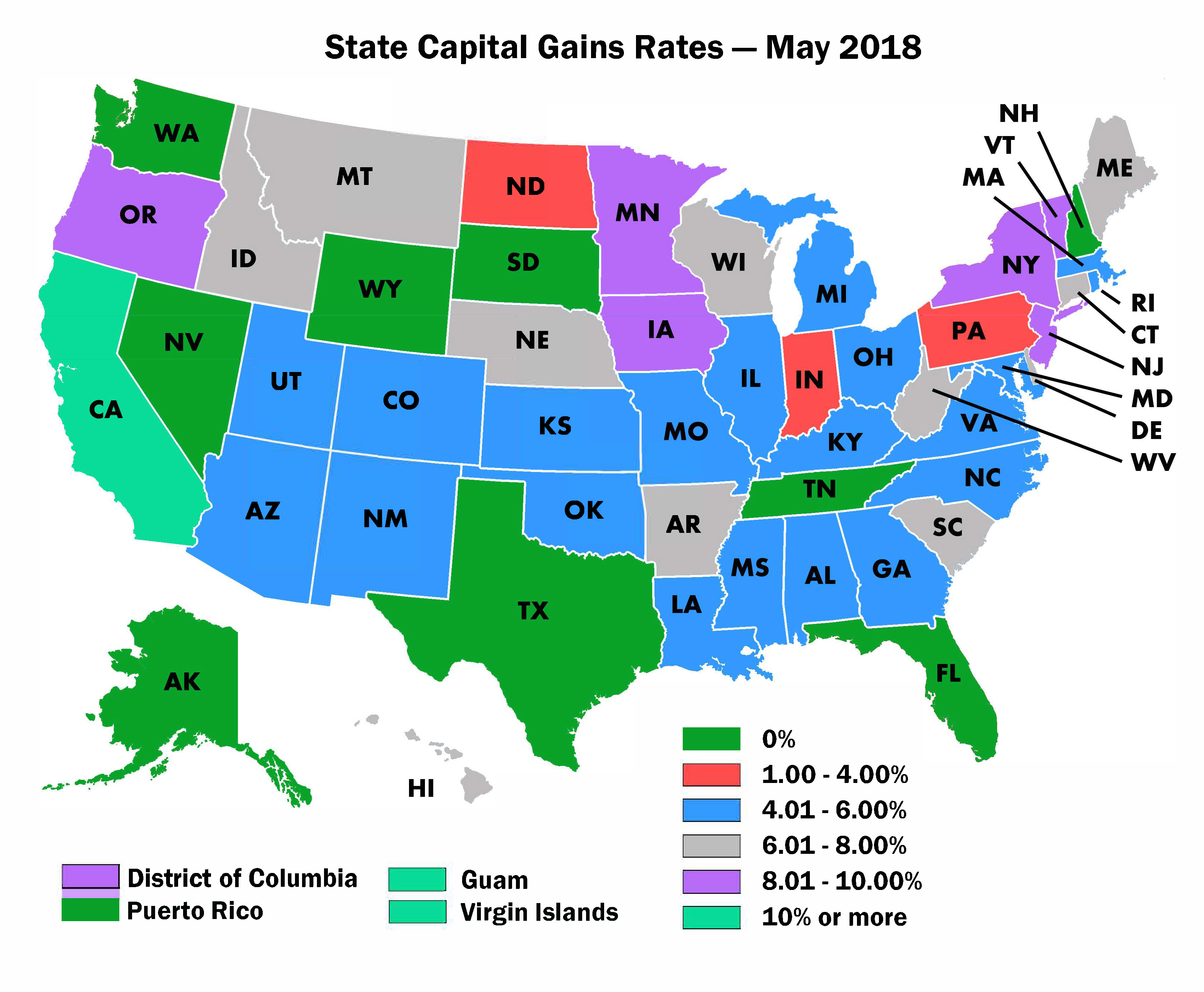

2022 Capital Gains Tax Rates By State Smartasset

Real Estate Capital Gains Tax Rates In 2021 2022

Dor Responds To Capital Gains Income Tax Cease And Desist Letter Clarkcountytoday Com

Washington Ranks 15 On Tax Foundation S 2022 State Tax Business Climate Index Also Their Take On Wa Capital Gains Tax Opportunity Washington

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

News Release Archives Sen June Robinson

New State Laws For 2022 Expand Voting Rights Create Capital Gains Tax And More South Seattle Emerald

Is There A 7 Washington State Capital Gains Tax Michael Ryan Money

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

In A Blow To Progressives Douglas County Court Strikes Down Wa S New Capital Gains Tax The Seattle Times